3 reasons tech stocks, once hot, are suddenly not

A selloff in technology stocks Wednesday drove the Nasdaq and S&P 500 indices to their worst performances since 2022. The slump in high-tech follows a year-long rally by the “Magnificent Seven,” a group of seven industry giants that have led markets into record terrain.

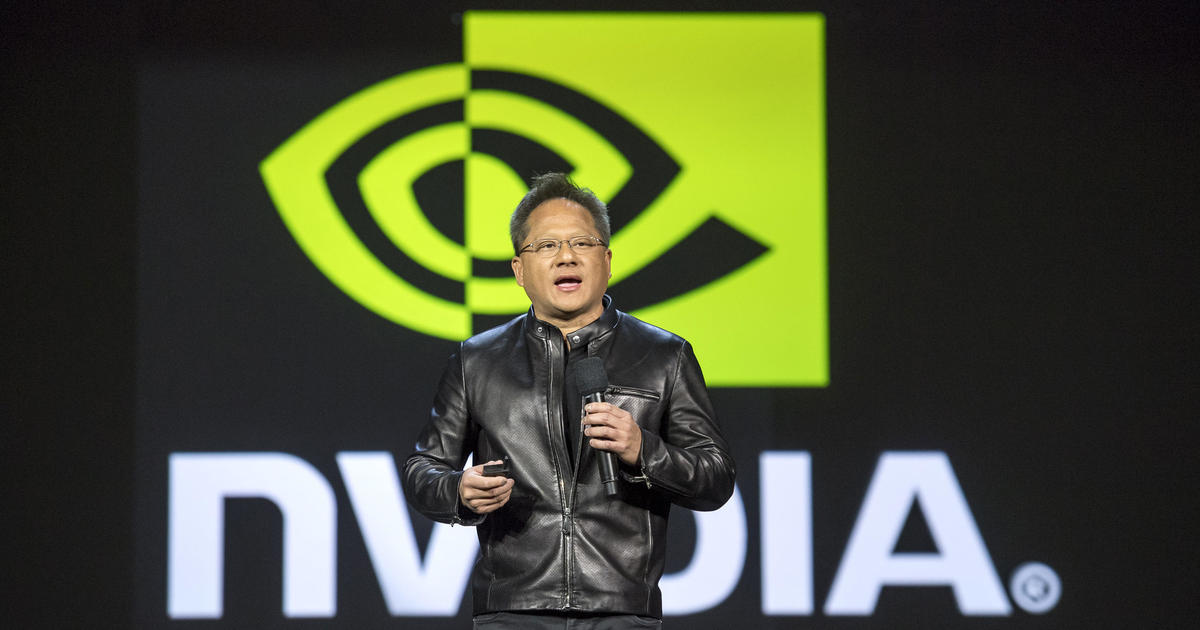

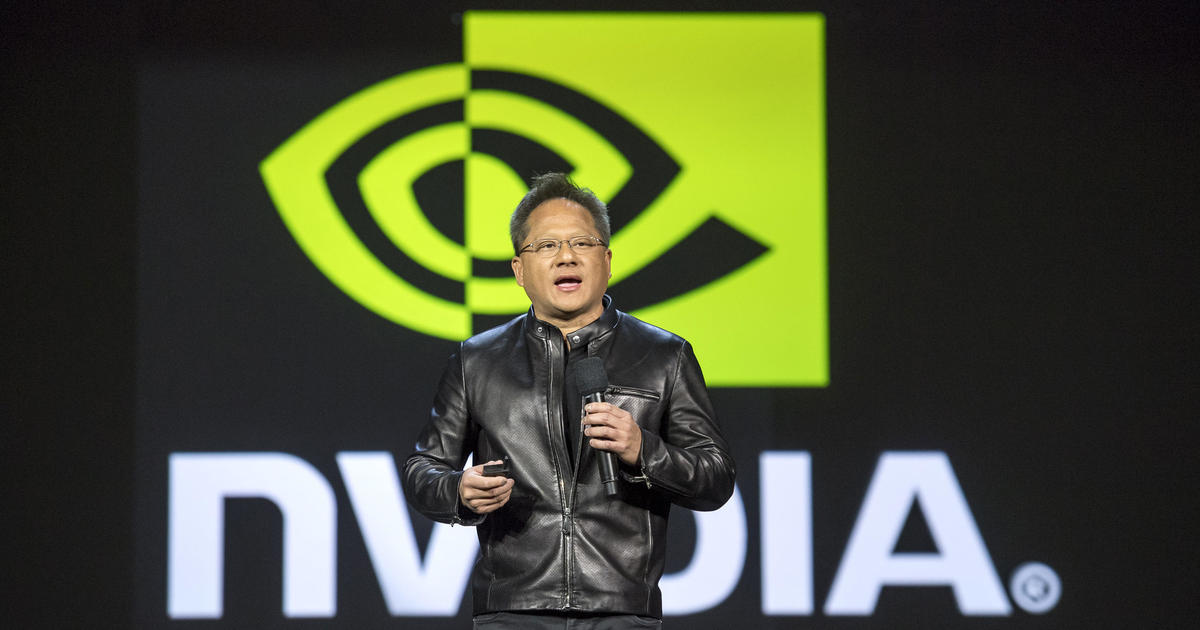

The slump continued on Thursday, with the tech-heavy Nasdaq index slipping 0.5% in morning trade. Chipmaker Nvidia shed 1.4% and Google-owner Alphabet fell 1.2%, while four other members of the group — Amazon, Apple, Meta Platforms and Microsoft — also lost ground. The only member of the group to gain on Thursday morning was Tesla, which rose about 3%.

The Magnificent Seven (sometimes called the “Mag Seven”) fueled two-thirds of the S&P 500’s growth last year, with investors betting that these companies would profit from their investments in artificial intelligence. But investors are now increasingly questioning whether the billions in capital funneled into the emerging technology will pay off anytime soon.

prices cooling faster than expected, spurred some investors to shift money into smaller stocks because of the expectation that the Federal Reserve could soon cut rates. That could provide an outsized benefit to these businesses since they are more reliant on borrowing than bigger companies, Lynch noted.

—With reporting by the Associated Press.

Aimee Picchi

Source: cbsnews.com