New York joins Colorado in banning medical debt from consumer credit scores

New York has become the second U.S. state to protect their residents’ credit scores from being tarnished by unpaid medical bills.

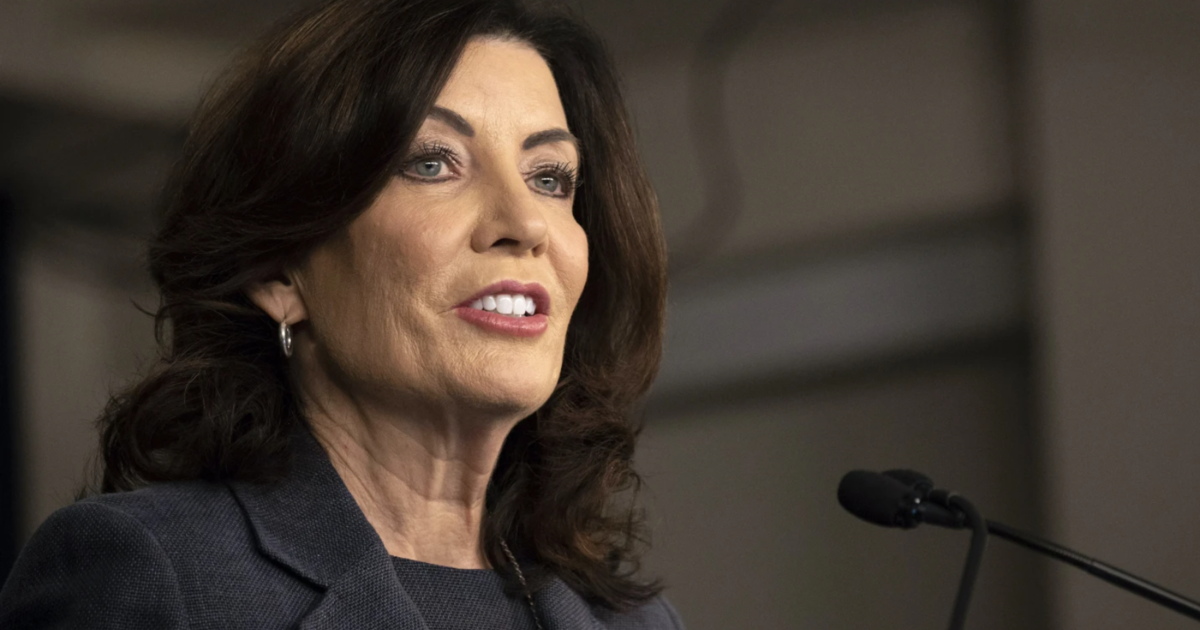

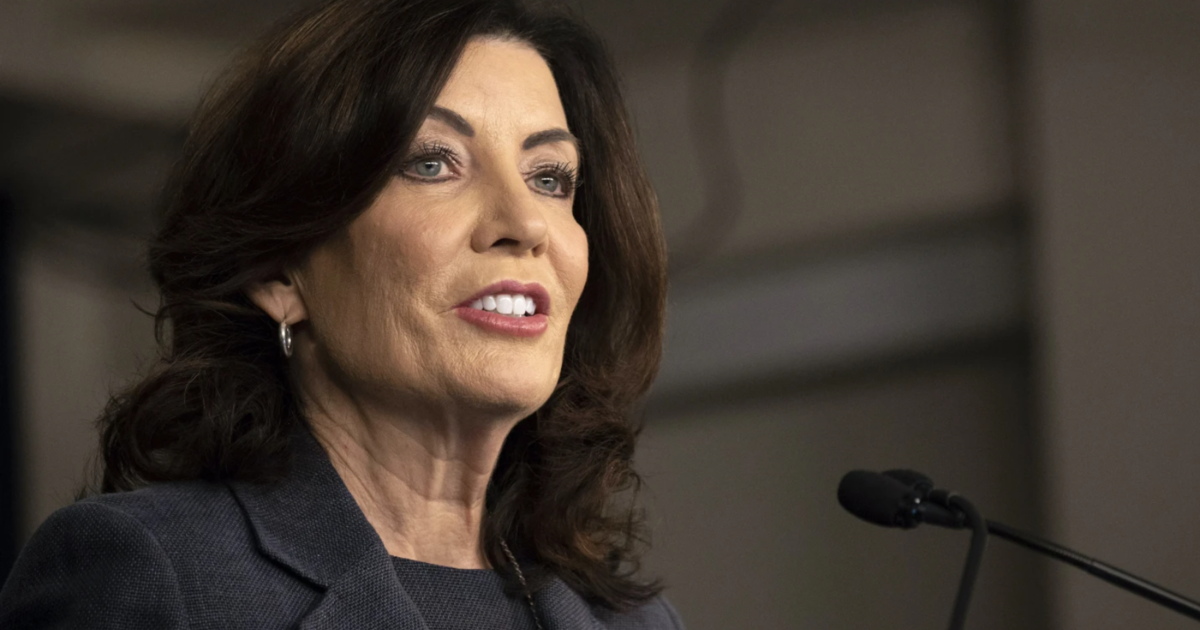

New York Governor Kathy Hochul on Tuesday signed a bill barring credit reporting agencies such as Equifax, Experian and TransUnion from factoring in medical debt in consumers’ credit reports. Colorado also excludes medical debt from credit scores, except in certain circumstances.

“I’m signing a bill that bans hospitals, health care providers and ambulances from reporting medical debt to your credit agencies,” Hochul, a Democrat, said at the bill-signing ceremony in New York City. “People can focus on getting healthier and not focus on whether or not someone’s going to catch you and trap you and make you spiral even more, so that’s what we’re talking about.”

Bad credit makes it harder to secure a loan, buy a house or car, or be approved for a credit card. Individuals with low credit scores also typically pay more for home or auto insurance.

“Many New Yorkers are drowning in medical debt that can be difficult to pay off, especially for those who may be struggling with a serious health challenge,” Chuck Bell, advocacy program director for Consumer Reports, said in an email praising the bill. “This new law will ensure New Yorkers won’t see their credit ruined because of medical bills that bust their budgets.”

On Your Side: Medical debt and your credit report

02:45

National crisis

Nearly 25% of Americans say they have past-due medical or dental bills they cannot afford to pay, according to an investigation by KFF Health News with NPR.

“Medical debt forces millions of Americans to cut back on food and other essentials, drain retirement savings, and make other difficult sacrifices,” KFF said in its analysis.

While medical debt impacts even high-income earners as well as the insured, it has a disproportionate impact on communities of color and lower-income people, according to the KFF-NPR investigaton. Nationwide, 28% of Black and 22% of Hispanic Americans carry medical debt, compared with 17% of White people, U.S. Census Bureau data shows.

“Medical debt is such a vicious cycle. It truly hits low-income earners, but it forces them to stay low-income earners because they can never get out from under it,” Hochul said.

A charity that abolishes medical debt

04:20

Hochul’s actions come amid efforts by the Biden administration to address the problem. In September, officials said they planned to develop federal rules in 2024 that, if adopted, would block credit reporting agencies from drawing on medical debt.

In lieu of federal protection, lawmakers in at least a dozen states have introduced legislation aimed at curtailing the financial harm caused by medical debt. Some of those bills would keep medical debt from tanking credit scores and create relief programs, while other proposals would protect personal property from collection for unpaid health care bills.

The credit reporting industry is also taking action as the issue draws increasing scrutiny from lawmakers. Equifax, Experian, and TransUnion agreed last year to drop most medical debt from credit reports. This year, the companies have stopped including medical debt of less than $500.

A blow for health care providers?

While consumer advocates say more needs to done, critics claim that removing smaller medical bills from a person’s credit report makes it harder for health care providers to collect payment.

“Historically, the risk that an unpaid medical bill under $500 could be reported on a consumer’s credit report incentivized the patient to pay the bill,” argued a California doctor in a class-action lawsuit he filed in August against the three credit bureaus.

“Medical providers now have a more costly path to collect payment on unpaid medical bills, if they can feasibly collect at all,” the complaint added.

Some Republican lawmakers fear New York’s new legislation could also have unintended consequences.

Republican Assemblymember Josh Jensen, who voted against the bill, said that while there is a need to ensure people aren’t financially haunted by emergency medical debt, the legislation is too expansive and shouldn’t apply to non-emergency care.

“There’s a concern that people could incur an amount of debt with no intention to pay it back, rather than the intended reasoning of the legislation to ensure people who need that critical care can get it without worrying the debt will follow them around forever,” he said.

New York’s law takes effect immediately. “No one should ever have to make a horrible choice between their physical health and their financial health,” Hochul said.

—With reporting by the Associated Press.

Source: cbsnews.com